Ripple? Ethereum? Litecoin? As of November 2017, there were 1300+ cryptocurrencies available and new cryptocurrencies can be created at any time. By market capitalization, Bitcoin, started in 2009, is currently the largest blockchain network.

Many in the ‘business of IT’ are actively attempting to keep up with the technology so they can sell more services, software, support, etc. Is that even possible with so many cryptocurrencies using a plethora of hashing algorithms? Some support encrypted mail with attachments, some use POW and POS functions, some leverage Cunningham chains, while others are for private cryptocurrencies, or even hybrid public / private blockchain solutions.

More importantly, have you spent equal time on investing, or at least investigating investing, in this technology?

Looks a lot like a Vegas poker chip doesn’t it? 😊 “In cryptocurrencies we trust” – boy, that’s rich…

Bitcoin investor Cameron Winklevoss, reportedly the world’s first bitcoin billionaire, views bitcoin as gold 2.0. Winklevoss’ view is, you don’t need to understand the technology behind the platform. Most of us don’t know how the internet really works but we are comfortable using it.

Using the Gemini cryptocurrency exchange founded by Winklevoss and his twin brother, the next major catalyst could be the CBOE bitcoin futures contract. “We are the price mechanism for the contracts when they settle,” Winklevoss said.

Personally, my investment in Litecoin has grown 3x in 3 weeks and my initial investment in bitcoin has doubled in value in only 9 days.

What is happening?

As our society has become more digital, financial services providers (and others) are always looking for ways to provide us the services we’ve come to expect – but in a more cost effective, secure, and efficient way.

Blockchain is simply a ledger of transactions. It is a way to digitally, and anonymously, send payments between parties without the need of a third party to verify the transaction. As you can imagine, it was initially designed to facilitate, authorize, and log the transfer of cryptocurrencies – a shared database populated with entries that are securely and efficiently created in a tamper-proof log of sensitive activity. Anything from shareholder records, to international money transfers, to any number of common bitcoin functions.

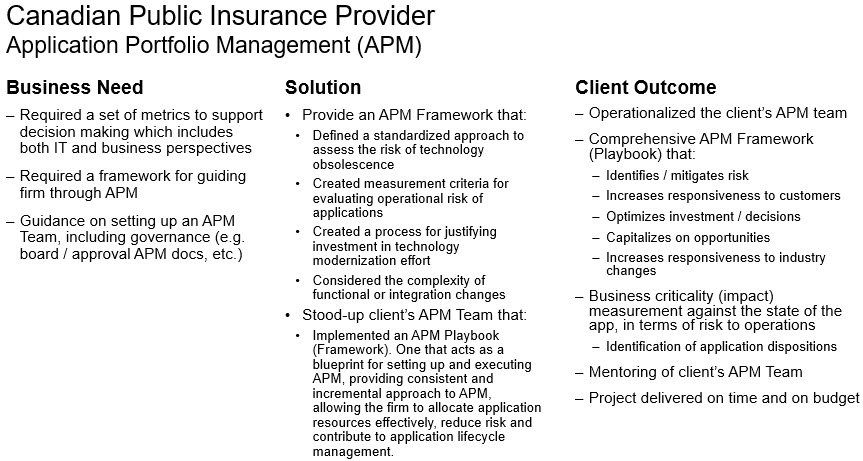

Simply put, it has given companies a secure, digital alternative to existing banking processes that are typically bureaucratic, time-consuming, paper-heavy, and expensive. What is the impact on your client’s current software portfolio and business processes? More importantly, how do you turn this impact into an offering that you can actually sell successfully in this ultra-fast-moving market?

What are cryptocurrencies and why should you invest?

Cryptocurrencies are digital money. A digital tool of exchange that uses blockchain technology to conduct secure and anonymous transactions.

Overstock.com (https://www.overstock.com/) has been using cryptocurrencies since 2014. Advanced Micro Devices (http://www.amd.com/en/home) and Nvidia (http://www.nvidia.com/page/home.html) produce graphics processing units (GPUs) necessary for bitcoin mining. In November of this year, Square Inc (https://squareup.com/), tested bitcoin payments on its cash application (I made a killing thank you very much!). In August 2017, Snap Interactive (http://www.snap-interactive.com/), host to some of the world’s largest video-based online and mobile communities, began accepting bitcoin as a form of payment in two if its applications – Camfrog and Tinychat.

Should you invest? That is like asking me should you to invest in FANG stocks.

Yesterday, I received an email from the Coinbase Exchange on the subject of “We’re continuing to invest heavily to scale our platform.” In order to increase their trading capacity and maintain availability of service they have increased the size of their support team by 640%, launched phone support, and invested ‘heavily’ in infrastructure, increasing the number of transactions processed during peak hours by over 40x. Sounds like business is booming.

Cannibalization of existing software and processes

- What is blockchain doing to your customer’s existing software platforms and the business processes they support? Which will become obsolete? Which need replaced now? Which will be revolutionized? Which need upgrades in computing power and infrastructure support? Answer these and you have an abundance of opportunities.

- This month, two of the world’s biggest exchanges will begin trading bitcoin futures, pushing it further into the mainstream and, by default, establishing a layer of official oversight that hasn’t previously existed. What is the impact to your firm’s existing business and sales models? You simply must be able to answer with clarity to survive this revolution.

- Blockchain technology has numerous uses, not just in banking, but in the Internet of Things (IoT). Blockchain is a tool that will transform parts of the IoT and enable greater insight into assets, operations, and supply chains. Even if you have a client already using blockchain, how can they broaden its functional footprint? Answer that, and you will have a customer for life.

- There is an enormous potential to transform how health records and connected medical devices store and transmit data. Supply chain, distribution, warehouse, shipping, you name it…

- Impacts to existing security capabilities – the sky is the limit.

- Your 401K and IRA – are they immune?

Your focus should be on answering the question, “who is likely to dominate their industry in the digital revolution?”

Risks

Were there risks when the United States migrated from an agricultural-based economy to one that was industrialized? In our lifetimes, we’ve seen this same industrialization being replaced by a services-based model. How many people have you personally known that lost their jobs during this transition?

What are the risks of accepting a method of payment with 20% daily price swings? Pranav Ghai, CEO of Calcbench stated recently, “I’d rather be paid in Venezuelan Bolivers. At least I can go there and get a great cup of coffee.”

What happens when a developer or group of developers proposes a modification to the bitcoin network? What will the impact be to your customers? What will the impact be to your offerings to your customers? And, as importantly, what will the impact be to your retirement investments?

Security, security, security! And not just the SW and HW that make up a secure network. What about the ‘humanistic’ side of security. How in the Sam Hill (love this old euphemism) do you convince your client’s leadership team that you have the solution to all their concerns about this — this, this currency that really doesn’t exist, rather, it’s just a bloody computer code? You will be a ‘better man than Gunga Din’ if you can tackle that consistently.

Cryptocurrencies are not the currency of any government, nor are they linked to any company or fund. Coupled with their inherent volatility, the Securities and Exchange Commission (SEC) is starting to pay attention. First up? Bitcoin ETFs. When (not if) ‘big brother’ enters the picture, what will that impact be to your customers, your offerings, your investments? Impacts on compliance, regulations, documentations, adherence, the list goes on and on…

And, if the origins of bitcoin are not sketchy enough (just who is Satoshi Nakamoto anyway? Did he not used to work for Charlie Chan or was it Mr. Moto? I can’t recall…), virtual wallets are always subject to potential hacking and theft.

However, one of its biggest critics, Jamie Dimon, CEO of JPMorgan Chase is beginning to soften his negativity. He’s moved from “a fraud” (September 2017 quote), to “If you’re stupid enough to buy it, you’ll pay the price for it one day.” (quote in October 2017 when bitcoin was selling for $5,800) to “highly skeptical”. He adds, “I’m open-minded to uses of cryptocurrencies if properly controlled and regulated,” in a recent quote.

Do we have a chicken and egg scenario here? Is investment in cryptocurrencies driving the use of blockchain or visa versa? It is still somewhat early days – you be the judge.

In October of this year, JPMorgan Chase announced that it was launching a blockchain-based system with two other banks to reduce global payment transactions. Now that is something your firm and your clients can wrap the brain around – reduced costs, faster transactions, more secure transactions, less third parties, etc. Now your talking…

Simply put, blockchain is going to be ‘transformational’ for the financial services industry. More importantly, what industry is next? What can you be doing to prep your clients that reside in this ‘next’ industry?

Increased usage is becoming burdensome. Just today, Revolut, a mobile-only banking startup, reported that customers were having a ‘tough time’ accessing their application on Thursday. Personally, I don’t have that problem with Fidelity. Do you? Sorry, couldn’t help myself…

Invest or not to Invest?

Invest or not to invest – that is (always) the question, is it not? Which fund(s) to invest in? Which stock(s) to sell? Which Exchange-traded Funds (ETFs) or REITs to buy? Dozens of funds have sprouted up in 2017 to trade digital assets. ETFs are in the works as well with today’s launch of CBOE and the 18 December launch of CME futures. Ask yourself, is investing in cryptocurrencies not just another way to diversify?

Digital currencies are volatile and the prices can go up and down – significantly – in minutes!

The first step is to open up a digital wallet like Coinbase or Bitstamp. You will find, just like your firm and your firm’s customers, you will be ‘uncomfortable’ due to your security concerns. You very well could decide to go to Las Vegas instead. You could at least earn American Airline miles and Marriott points for your troubles.

Digital wallets need to be linked to your bank account. Uncomfortable now? And yes, there are transaction fees just like buying / selling stocks, ETFs, and mutual funds.

Warren Buffett calls this whole concept “a mirage”.

The great showman P. T. Barnum is credited with coining (no pun intended) the phrase, “There’s a sucker born every minute”.

You decide, like P.T. Barnum, does Mr. Buffett represent the future or the past?

In closing…

The concept of blockchain is far more reaching that just tracking digital tokens. Banks and financial institutions are envisioning new uses daily.

Remember, “who / what is likely to dominate their / the industry in the digital revolution?”

I’ve left you with more questions than answers, I know. But isn’t that the definition of the future? Flip that premise, and you could become a ROCKSTAR!

In the time it took to author this blog, I made another 3.59% on Litecoin. While proof reading, I was up 17.26%. Did I fail to mentioned that these markets never close – 24/7 trading. On the other hand, I may lose it all in the time it takes you to read this. Can your client’s network and culture adjust? Can your IRA?

See you in the future…

Frank Wood

Executive Transformation Advisor

frankwood944@yahoo.com